By: Beth Akers and Matthew M. Chingos

College tuition and student debt levels have been increasing at a fast pace for at least two decades. These well-documented trends, coupled with an economy weakened by a major recession, have raised serious questions about whether the market for student debt is headed for a crisis, with many borrowers unable to repay their loans and taxpayers being forced to foot the bill.

In this report, Beth Akers and Matthew Chingos analyze more than two decades of data on the financial well-being of American households and find that in reality, the impact of student loans may not be as dire as many commentators fear.

The authors draw on data from the Survey of Consumer Finances (SCF) administered by the Federal Reserve Board to track how the education debt levels and incomes of young households evolved between 1989 and 2010. Their analysis produces three particularly noteworthy and new findings:

Roughly one-quarter of the increase in student debt since 1989 can be directly attributed to Americans obtaining more education, especially graduate degrees. The average debt levels of borrowers with a graduate degree more than quadrupled, from just under $10,000 to more than $40,000. By comparison, the debt loads of those with only a bachelor’s degree increased by a smaller margin, from $6,000 to $16,000.

Increases in the average lifetime incomes of college-educated Americans have more than kept pace with increases in debt loads. Between 1992 and 2010, the average household with student debt saw an increase of about $7,400 in annual income and $18,000 in total debt. In other words, the increase in earnings received over the course of 2.4 years would pay for the increase in debt incurred.

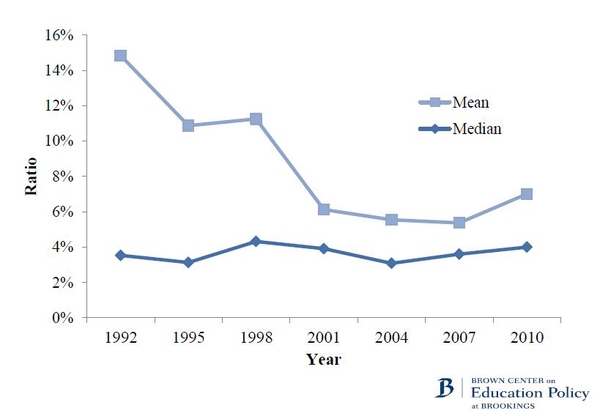

The monthly payment burden faced by student loan borrowers has stayed about the same or even lessened over the past two decades. The median borrower has consistently spent three to four percent of their monthly income on student loan payments since 1992, and the mean payment-to-income ratio has fallen significantly, from 15 to 7 percent. The average repayment term for student loans increased over this period, allowing borrowers to shoulder increased debt loads without larger monthly payments.

More:

http://www.brookings.edu/research/reports/...

Posted By: How May I Help You NC

Posted By: How May I Help You NC

Tuesday, June 24th 2014 at 3:39PM

You can also

click

here to view all posts by this author...